Grab enables peer-to-peer fund transfer to foster digital payments in Singapore

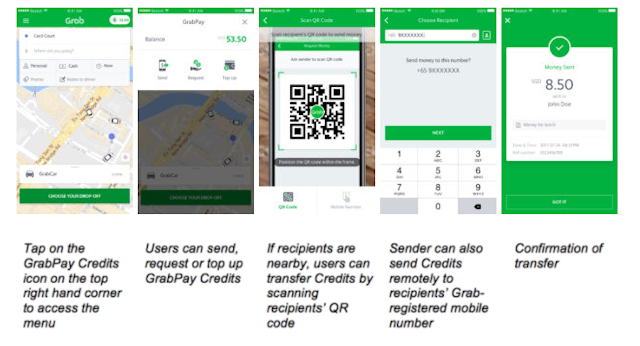

After recently launching GrabNow to encourage taxi drivers to go cashless, online cab hailing service Grab has now introduced a peer-to-peer fund transfer feature to enable consumers to transfer GrabPay credits to one another in Singapore.

Grab enables peer to peer fund transfer to foster digital payments

Grab plans to further develop the technology to expand its inventory beyond transportation via GrabPay, Grab’s in-app mobile wallet to foster Singapore government's vision of a cashless economy.

Jason Thompson, head of GrabPay, said: “Every day, over 75% of Grab users in Singapore go cashless and use GrabPay to pay for rides. Grab users are familiar with using mobile payments for daily transactions, via the Grab app. Fund transfer is the first step to expand the use of GrabPay as a mobile wallet. Today, users can transfer money to one another; in the coming months, they can look forward to use GrabPay to buy food or other goods and services from physical shops.

“Cashless payments in Singapore is still quite fragmented. Mobile payments is more infrastructure-lite, and as one of the most frequently used consumer apps, we believe Grab can drive mass adoption of mobile payments in Singapore and across Southeast Asia. We have a stake in educating and bringing local communities into the cashless future, and are open to working with public and private sector organisations to enable this,” he added.

Grab recently partnered with Toyota to improve access to connected car services.

Meanwhile, Grab's rival Uber recently announced Unified Payments Interface integration to unlock the potential of fintech innovations in India.