Investors are still hopeful about adtech, and here's what they’re looking for

The use of adtech is now mainstream but this brings with it increased competition, as well as scrutiny, and with early stage investors in the sector eager for a return-on-investment, many are now feeling the squeeze. But amid the headlines of struggling adtech companies on the public markets, plus much talk of distressed exits, not all are so downbeat.

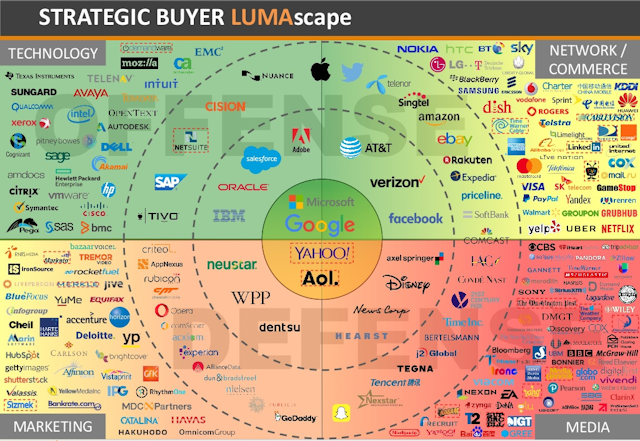

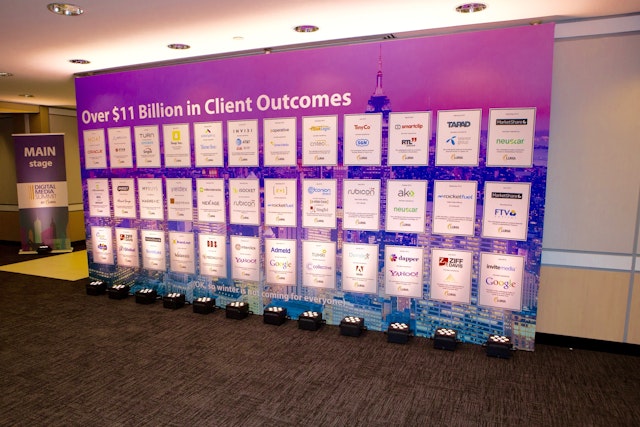

Speaking recently at an event hosted by Luma Partners – widely touted as the most exclusive, and high-powered event in adtech if the CEO-count is considered – representatives from some of the foremost investment funds in the sector shared their opinions on how entrepreneurs can win their favor, plus their changing views on a successful exit.

Typically, investors want to see: less reliance on typical managed service buys, or I/Os; technology with a heavy focus on machine learning; plus the ability to effectively execute consolidation. Read on to hear some of the opinions shared by venture capitalists and private equity funds that took to the Digital Media Summit 2017 stage.

Rumors of the death of adtech have been greatly exaggerated

Chris Fralic, of First Round Capital (whose investments include Flurry, which eventually sold to Yahoo, and Moat, which later sold to Oracle, as well as AppNexus), describes a “shift in perception” as regards exit opportunities. In the last number of years the expectations of adtech exits ranged from “irrationally exuberant” to the current climate, where a mood of caution prevails.

However, when presented with Luma Partner statistics suggesting that during the 12 months alone there has been over 50 adtech exits north of $100m, Fralic is struck with surprise at the “disconnect” between these figures and popular perception.

“Right now, it’s in a bit of a tough place, but if we look at the statistics, it almost doesn’t add up, it doesn’t feel like that,” he says. “I'm cautiously optimistic overall, there’s a lot of good signs out there that the companies that are left out there and still standing will go home, and will go public.”

Meanwhile, Chris Young of Revel Partners (an early stage VC firm whose investments include Beeswax and The Trade Desk) claims there is still a lot to be optimistic about within the adtech sector, commenting: “There are some depressed valuations that just [provide] more opportunity.”

But the wind is clearly in the sails of martech

Paul Martino, of Bullpen Capital (whose investments in the space include LiveIntent), adds: “The public markets simply do not in any way, shape, or form, reward I/O- or campaign-based companies. Period. And, as a result, if you’re looking at the downstream investment environment, if a company doesn’t have a platform or SaaS orientation, or can at least act like it does, there’s no chance of investment from our firm.”

Martino observes: “Unfortunately we live in a dual world, if you do not have a predictable, recurring revenue-type spot, then you’re a 2X company, if you’re a SaaS company, you can get 10X."

He goes on to explain his outfit’s opinion that attempts to delineate between “sales tech”, “adtech” and “martech”, etc., are moot, especially when it comes to market valuations.

“When we look at a company we don’t care about that at all, when we look at a company we go ‘okay, [this company’s revenue is] campaign-based or SaaS-based, thanks, that’s all we need to know’,” he pointedly comments.

“And that’s the nature of the downstream market…as a result, a lot of companies have higher private market valuations as opposed to public market valuations," he says.

Stephen Master, of GTCR adds that private equity groups are likely to respond positively to the much touted clean up of the adtech sector. The old world of opaque business practices where the emphasis was on selling impressions of questionable value, in the hope of generating profit via way of arbitrage was difficult for private equity to invest in, he says.

But is it another 'bubble'?

Sheila Spence, formerly of WPP, and soon to be Spotify’s in-house M&A specialist, questions whether the current enthusiasm for martech is similar to the “adtech bubble” of years gone by?

Although Revel Partner’s Young points out that the enthusiasm for martech is in part fueled by the dominance of the industry’s ‘walled garden’ players (he includes Amazon in this category) as both sides of the media industry need to equip themselves with identity management tools.

“There’s a lot of ripe stuff going on to reinvent, or advance the marketer/consumer relationship, and I think that artificial intelligence (AI) is going to play a big part in that. So I think we’re far from a situation where we have an over-investment, or an overvaluation in martech specifically,” he adds.

Are we still at the 'growth at any cost' stage?

In the early days of adtech, the amount of investment from VC firms encouraged a “growth at any cost” mentality, plus the (then) seemingly infinite willingness of investors to fuel said growth led to “some undisciplined behavior that has caught up with a lot of people”, according to Fralic.

By this he means that many startups placed too much of an emphasis on tactical short-term growth (ie taking I/O's) at the cost of strategically positioning themselves well by investing in the longevity of their tech.

Reflecting on this, Revel Partners’ Young advises leaders in the adtech space to “look under the hood” of their offering. Important points to consider are whether or not said technology has a self-service element (as this is a more scalable proposition), plus “the coming wave of AI”.

He goes on to add: “If you’ve got an issue there, think about raising, and if you don’t, then get profitable [as opposed to raising more funding] because that drives a lot of optionality [in terms of exits].”

Other participants on the panel note how startups' "use of proceeds deck” is the ultimate litmus test; investors are currently less likely to invest in “potential” compared to previous years. Instead they are more interested in “proven customer business models”, according to GTCR’s Master.

The difference between now and 10 years ago

“Ten years ago there was a in rule in venture [capital]: don’t ever take your first money from a strategic. But now with the [funding] rounds so fluid, and the seed [rounds] so often, and the notes so rolling, it’s no longer the rule. If a WPP has come in [with investment], that’s a good signal as opposed to a quasi negotiated pre-sale,” says Martino.

“I think corporate strategics are also behaving better, and they know that in order to play this early stage game they need to act like financial investors, as opposed to buying call options on the companies…it’s much better for the entrepreneur because the strategics are a much more available option for financing that doesn’t screw up the cap table.”

Meanwhile, GTCR's Master claims that private equity can now tolerate principal loss on maybe 15% of their investment portfolio, a change in attitude compared to a decade ago.

He adds: "Maybe 10% for a good fund, so we [have] to be able to close our eyes when we’re meeting with a company and project out five to seven years, and have a high degree of conviction that this company will be worth at least as much at that point in time as they are now.

"We’d gladly trade at least quintupling the size of the business just to have the extra comfort that it will look similar to the way it does now, and when you do that the evolution of moving towards business models that are frankly much more defensible than were common in 'adtech 1.0', it helps out a lot."

The ability to integrate and consolidate well is now an investable asset

Additionally, given the current trend for mergers in the space (for instance, how Verizon Wireless is in the process of merging its AOL and Yahoo units into Oath) the ability to effectively rationalize infrastructure and operations, is now of interest to private equity investors such as Master.

Given that the pace of venture capital flowing into adtech startups is on the wane, many entrepreneurs will have to look at merging with potentially complementary outfits in the space. And with private equity groups heavily rumored to be looking to buy multiple adtech assets, and then rolling them into one outfit, this is a key consideration.

“There’s a lot of companies out there with duplicative infrastructure, a lot of synergies to be had, and a lot of capacities to be built into larger businesses, plus a lot of value to be created that way,” adds Master.

Are adtech companies now just happy to remain private?

As the adtech sector enters its next phases of maturity, many entrepreneurs in the industry are pained by tales of of ill-advised exits, also known as "liquidity moments". Some industry commentators note how many of the early phase adtech companies are effectively psychologically scarred by such instance, and thus want to remain private; even as they approach the scale that would formerly have suggested an IPO.

Revel Partners’ Young is adamant that big ticket exits, such as an IPO or purchase from a strategic buyer, are the ideal outcomes for any of his funds’ investments after a holding period of five years (after initial investment).

Although Bullpen Capital’s Martino differs slightly, maintaining that “we are now in a new world”. He adds: “We have a couple of portfolio companies that are generating tens-of-millions of dollars in free cash a month, and those CEOs have zero desire to go public…we actually have a couple in that spot that don’t want to do all the things required to go public…this is happening more than people appreciate.”

The rising influence of private equity

Martino also reports increasingly seeing “quasi rounds happen as well”, whereby private equity firms (which typically want to own majority stake, if not 100% of a company) buy a stake from early stage investors (typically VCs are not as risk averse as private equity, and more willing to spread their investment interests), happen in the industry.

“Private equity people are buying interests to get closer to their ownership targets, taking heat off people like me, we get out 10X our basis, and then [let] the rest ride, so I think we’re going to see more of that because maybe it’s the best balance of interests,” he adds.

“And it’s not that you’re less interested in those companies, it means that you can stomach the exit essentially being indefinitely far out because you’ve covered your basis-plus back.”

Is addressable TV the next big payday for adtech?

Speaking separately with The Drum, Eric Franchi, the cofounder of adtech outfit Undertone (which recently sold to a private equity firm, so he is subsequently interested in his own startup investments), describes his appetite for areas to invest in, away from the adtech and martech sector.

He adds: “Investors need to pay attention to the opportunity ahead. Over $70bn of US television spend will ultimately make its way into digital advertising. Roughly doubling the size of the addressable market.

“Big opportunities in measuring real identity versus anonymous cookies and actual business outcomes will help marketers justify increased spend. Let alone the influence of machine learning, AI and computer vision. These are the blind spots investors and the rest of the industry need to pay more attention to."

The State of Digital Media

The panelists were speaking at Luma Partners' Digital Media Summit, where it also presented its flagship annual report The State of Digital Media. Terry Kawaja, chief executive officer of Luma Partners, points out that stocks in publicly listed adtech and martech companies have increased by over $8bn over the last 12 months, albeit this is predominantly driven by the increased valuations of martech outfits.

However, the decrease in valuations, plus headlines prophesying the end of adtech are somewhat premature, rather, the sector is entering a new phase, according to Kawaja.

He adds: “You can see the decline in the appetite for venture capital funding in adtech and martech startups…but it’s not the end of the world, we think we’re at a maturation stage...because venture capital funding is down, but private equity funding is way up and that is maturation of the sector.”

Download a full copy of Luma Partners' State of Digital Media report for free here