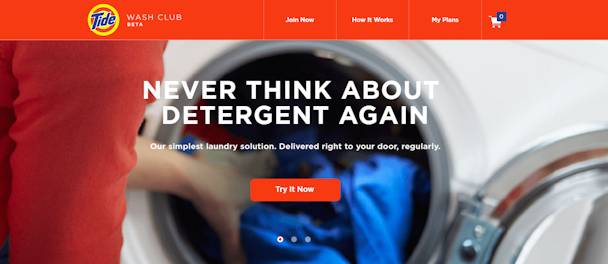

P&G trials a subscription service for Tide washing powder

P&G is trailing a subscription service for its Tide washing powder as it presses ahead with its plans to be “more present” in direct-to-consumption e-commerce channels.

Tide

But, beyond that, the FMCG-giant was reportedly caught off guard by how popular the Dollar Shave Club – an online subscription service for razors – proved to be among consumers, and the resulting effect it had on sales if its own razor brand, Gillette.

Now, with Unilever having confirmed late last night (19 July) that it has bought Dollar Shave Club for some $1bn the reasons for P&G to up its game in this space are more apparent.

The experiments for how the model will work are still ongoing. In Atlanta it’s been testing it under the format of Tide Wash Club whereby people can sign up online and get the Tide Pods variant delivered for free at regular intervals.

Elsewhere, Tide Spin is being tested in Chicago where, through an app, members can order their washing to be picked up and delivered by Tide-branded couriers.

A P&G spokesman told The Wall Street Journal that the company has been using “every opportunity we can to learn about consumer habits and practices and our experiences on Tide are consistent with this.”

The popularity of subscription models and people’s propensity to sign up if they feel they are getting value have been proven by the success of Amazon Pantry and its dash button – which Tide was also quick to embrace.

And of course, the Dollar Shave club has seen sales steadily increased since its launch from a reported $4m in 2012 to $154 million in annual revenue in 2015 thanks to its now three million subscribers, something P&G will be crossing its fingers it can emulate.

However, the success of the Tide Wash Club model will live and die with how competitively it prices against traditional retailers. Currently, in comparison to buying directly from Amazon, for example, P&G works out more expensive.

There’s also the tricky issue of what this means for its retail partners, like Walmart. Last year WPP boss Sir Martin Sorrell said there is a “great shift in the balance of power between retailers and manufacturers” happening as the latter strengthen their ability connect directly to the consumer.

At the root of all of this, as Steven Moy is chief executive at Isobar UK explains, is P&G desire to foster loyalty.

“With carefully planning and without cannibalizing the retail distribution, Brands, like Tide, with subscription services would benefit from direct selling to consumers,” he said.

“The most strategic benefits allow Tide to have a direct relationship with the consumer, capturing all the relevant data. P&G can create a loyalty program directly with consumers and the new data can drive more marketing intelligence for new product development and marketing effectiveness.”