Ad tech M&A continues to rise as investors continue to pummel stock prices

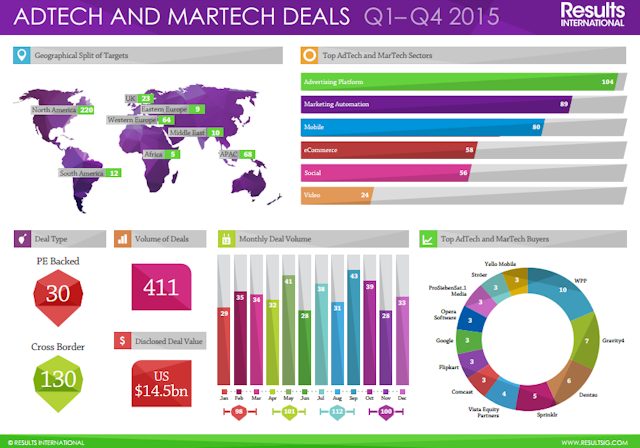

Ad tech acquisitions surged between Q3 and Q4 last year, with such providers accounting for almost a third of all M&A deals in all of the ad tech/martech sector during the final quarter of last year, according to a study from Results International.

The research found that marketing automation mergers and acquisitions (M&A) is on the increase, with advertising platforms resurgent in Q4, compared to the previous quarter, although the number of deals in the sector was down year-on-year.

The number of deals involving ad platforms fell from 31 per cent of all ad tech/martech deals in 2014 to 25 per cent in 2015, a fall in absolute terms from 137 deals in 2014 to 104 in 2015, with Julie Langley, a partner at Results International, describing last year as "difficult" for ad platforms.

"Even with a strong Q4, deal volume has fallen. The uplift in Q4 may well signal an increasing convergence of valuation expectations between buyers and sellers, following a difficult Q1-Q3," she added.

Langley also added that the overall trends indicated that the trend towards marketing automation as a whole was really on the rise, with private equity (PE) and network agencies (such as WPP) the most active acquisitive in the sector.

The research shows that 7.3 per cent of ad tech/martech deals in 2015 were private equity-backed, up from 6.5 per cent a year earlier, with WPP identified as the most acquisitive network agency during the year having purchased outfits such as Medialets, ActionX and ExchangeLab.

“The fundamental drivers of deal activity, technological innovation and rapidly changing consumer demand, remain valid and we expect to see continued strong activity through 2016,” added Langley.

A separate part of the Results International study (published yesterday on The Drum) demonstrated that the number of merger and acquisition deals involving integrated marketing services agencies rose last year while digital agencies continued to be the most popular sector for investment.

A total of seven ad tech companies made an initial public offering (IPO) between June 2013 and July 2014, including Rubicon Project, Tremor Video and TubeMogul, accounting for six per cent of global tech IPOs during the period.

However, many (but not all) have seen their initial stock prices take a considerable hit since then (such as RocketFuel), with many attributing the declining stock prices to a misunderstanding of the sector (or at least a lack of understanding over where their revenues come from) on Wall Street.

Commenting on the difficulties experienced by ad tech companies that have IPO'd, Langley added: "Going public has not been a viable option for most adtech companies this year given the poor performance of most listed adtech companies over the past 12 months.

"Therefore we have seen strong interest in M&A as an exit route. While agencies such as WPP and Dentsu are among the most acquisitive buyers, there isn't a particular sector that is dominating M&A. Rather, there's continued strong interest from an ever-increasing pool of buyers, ranging from next generation MarTech unicorns such as Sprinkler to broadcasters such as Comcast, which goes to demonstrate the growing strategic significance of adtech."

A full copy of the report is available here