Integrated marcoms agency mergers & acquisition deals on the rise in 2016 Results International finds

The number of merger and acquisition deals involving integrated marketing services agencies rose last year while digital agencies continued to be the most popular sector for investment according to annual research released by Results International.

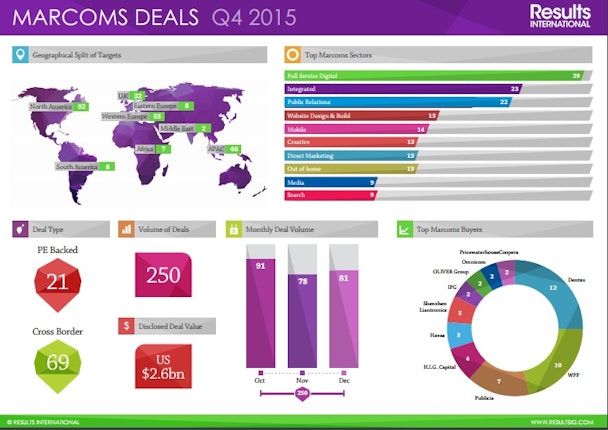

Research released exclusively to The Drum has revealed that full-service digital agencies were once again the largest sub-sector in terms of marcoms M&A deals internationally during 2015, with 29 deals taking place involving such businesses in the final three months of the year alone, 12 per cent of all deals globally.

Through-out the whole of 2015, full-service agencies made up a tenth of M&A deals it found, including the takeover of Dare by Oliver Group in the UK, Idox buying the UK presence of Reading Room and the Nicklefish acquisition in the US by Endava.

Meanwhile, the largest jump in demand was for integrated agencies which were involved in 8 per cent of all marcoms M&A agreements, a growth of 4 per cent on the previous year. These included Catapult Works and Make Me Social by R2 Integrated.

The world's largest marketing services group WPP was the most acquisitive of all the groups in 2015 with 38 deals in total, including the purchase of Essence Digital, ManvsMachine, Cleartab, Australian network STW Communications Group and Yonder Media during Q4 alone.

Dentsu was not far behind with 36 deals for the year, while Publicis had 12.

New acquiring companies also appeared with the Blue Rubicon deal completed by Teneo Holdings, as well as taking Stockwell Communications and Pendomer. Shenzhen Liantronics also acquired three Chinese businesses during the closing stages of the year within outdoor, integrated and SEO sectors.

Cross border deals made up for 30 per cent of all activity for the year, while most activity continued to take place within North America, at 42 per cent (412 deals) of all activity. In the UK activity slipped from 15 per cent in 2014 to 12 per cent in 2015, however Western Europe increased from 15 to 19 per cent.

The disclosed deal value for activity within the US was found to be worth $19bn.

Julie Langley, partner at Results International, explained that the increased interest in integrated agency ownership was likely to reflect "client-led trends."

"Many agencies set up originally to be specialists have increasingly expanded their service offering and re-positioned themselves as integrated, in response to client demand," she continued, adding that the M&A sector was "very robust" as new buyers emerged on the scene.

The most active month of the year for deals was found to be July with 106 overall.