Why TV is going nowhere, cord cutting is years away, and cable companies are safe

Earlier this month at The Wall Street Journal’s WSJD conference, Michael Wolf, Managing Director and Co-Founder at strategy and technology consulting firm Activate, delivered a presentation that must impress even KPCB’s internet trends guru, Mary Meeker.

Wolf’s tech and media outlook touches on the rise of messaging, streaming audio, and e-sports; more interesting to Found Remote readers, though, is the section on cord cutting (slide 58) and what the coming “cable killer” looks like.

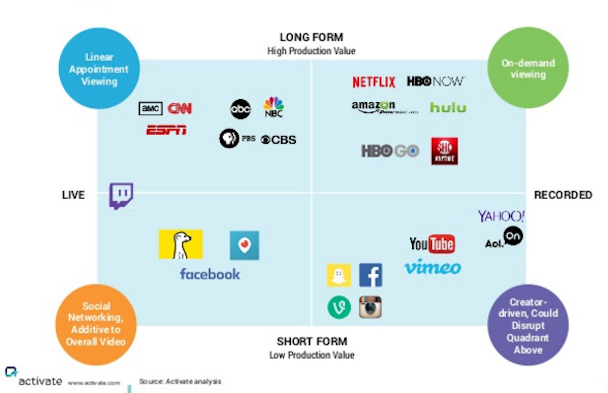

It’s easy to get excited about the sea changes taking place in the TV industry, and given proclamations made by the media, one would think that the whole world will be watching only short form video clips, via Snapchat, on their mobile devices. Wolf, to his credit, takes a step back, and the outlook for traditional media players isn’t as dire as it may seem.

Some of the insights:

There is more competition for consumers’ video time and attention, but traditional TV still captures 72 per cent of all viewing

Pay TV subscriptions still account for 55 per cent ($103 billion) of video revenues, and TV advertising accounts for 35% of video revenues.

The rise of time shifting and on demand means people are watching more TV than ever: 4h 56m in 2011 vs. 5h 54m in 2015.

Milennials, Gen Xers, and Boomers still overwhelmingly prefer to watch high-quality video on large screens

Bundling (especially when internet is involved) is actually an advantage for cable companies.

Below, our chat with Wolf followed by the presentation:

Found Remote: Many have predicted that the death of cable/pay TV will come within the next few years. Why is this unlikely?

Michael Wolf: The death of cable is over-rated and it will take at least a decade for substantial decline, based on our research. It's expensive and difficult to reproduce the deals that cable operators have in place. A company like Apple or Google may try to take on the cable operators and will find that their costs are significantly higher. We expect that they will compete for the high end of the market, rather than the mass or lower end, where there are skinny bundles and other incentives for consumers to stay with cable.

FR: What major advantages do cable companies still have over competition?

Wolf: Cable is entrenched in the American home and it will likely take a decade before consumers are willing to cut the cord. Cable deals are based on volume and have lower pricing than newer competitors would offer. They are also able to offer attractive discounts, skinny bundles, unbundling and 'triple play' incentives that include phone, Internet and cable.

FR: The trend right now is unbundling, yet in your report you say that a cable killer would need bundling in order to compete with a cable company's advantages. Why is that?

Wolf: Pricing in the industry is based on volume and a cable killer couldn't put together an attractive package for the average consumer without bundles. You are right that the trend is unbundling — and consumers will expect more of this, rather than less. So we see difficulty for cable killers to come in and upset the status quo at the moment. The strategies they need to compete aren't aligned with consumer trends and purchasing behavior.

FR: Do any of the cord-cutting platforms out there right now (Sling TV, Vue) stand a chance provide a serious challenge to cable companies?

Wolf: Netflix is in an astounding half of all American homes. That's a shocking statistic. Beyond that, we see millennial consumption behavior and new consumer entertainment devices driving some of these other platforms in the future but there's no clear leader or winner yet. It's still early days, given where technology infrastructure is in handling bandwidth.

FR: More video is being consumed on mobile and tablet devices, yet all age groups like watching long-form content on bigger screens. Are TV manufacturers safe for now?

Wolf: TV isn't going away, and in fact, the average American is still watching more than 5 hours of TV daily. What's surprising is that millennials are binge-watching TV while multi-tasking – surfing, messaging, playing games etc. Long-form is still preferred on large screens by every demographic but short form videos are being consumed on mobile and tablets.

You can access the Found Remote hub here. Sign up to receive The Drum's Found Remote newsletter.