Giles Palmer, CEO, Brandwatch takes a look at the results of the company's latest research into customer service in the aviation industry, highlighting the best performing brands in the space.

If you were to scan any of the papers from the last month, almost without fail every one will contain some kind of story about the failure of the Great British transport system to cope with the latest cold spell. But weather crises aside, on an almost daily basis the world’s airlines are bearing the brunt of massive volumes of complaints, comments and questions, as unexpected delays, unavoidable cancellations and other factors drive passengers to social media to voice their dissatisfaction and get answers. There is no doubt that the advent of social media has brought with it countless crises and disastrous instances of online service for airlines but it has also heralded new opportunities to connect with customers. Customer service is often a key factor for airline passengers when selecting which carrier to fly with; even more so with repeat customers. As a result, proactively engaging with customers and putting in strategies and processes to prepare for when things go wrong, can be the difference between a critical failure and soaring profits. That much seems obvious, but the question is; are airlines taking advantage of the opportunity social media offers for customer service? Ever curious, we recently undertook some research at Brandwatch to gather insights on the current state of airline customer service, discover which the top performers are and see where there is room for improvement.

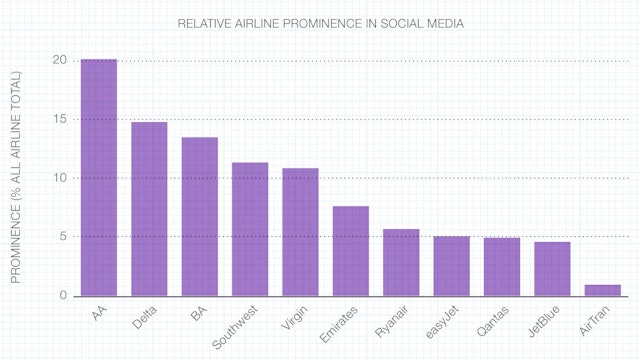

First class serviceWe included eleven of the world’s leading airlines in our analysis, chosen to show a snapshot of the aviation section across both low-cost and premium carriers as well as domestic and international services. We then analysed almost two million brand mentions of these airlines during a six month period, tracking relevant conversations from blogs, forums, social networks, review sites and rich media sites. Purely examining the results by volume alone American Airlines stood out as the overall winner, being most likely to be mentioned online, followed by Delta, British Airways and Southwest. Perhaps disappointingly for them the rival European airlines Easyjet and Ryanair received a similar share of online conversation to each other, just behind Middle Eastern airline, Emirates.

Relative airline prominence in social media

However, when we took into account a wider variety of factors including sentiment of tweets, number of followers and average number of tweets, only three airlines (Qantas, JetBlue and Virgin Atlantic) could be classed as having an overall positive customer service reception on Twitter.

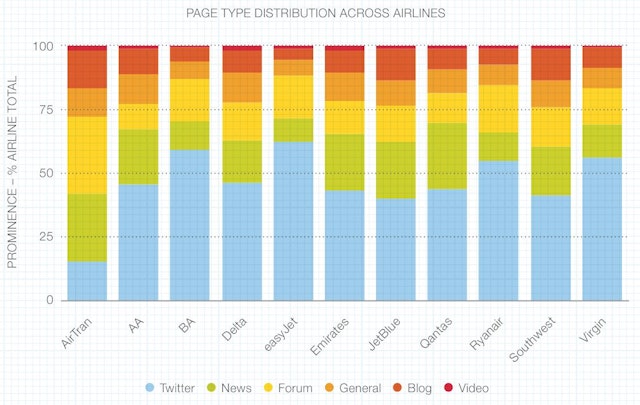

Location, location, locationAs is the case with most industries you look at nowadays, for almost all the airline brands, Twitter was by far the most prominent platform for customer comments. In fact it accounted for over 50 per cent of online chatter for at least four of the airlines – British Airways, EasyJet, Ryanair and Virgin Atlantic.

Page type distribution across airlines

Despite figures like these underlining the clear importance of having a presence on Twitter, there were a few notable examples of airlines with little to no activity on the site. Airtran, one of America’s low-cost airlines, doesn’t use Twitter at all, perhaps explaining why their brand is discussed more frequently on forums than any other airline. Even amongst those brands with an ‘active’ presence on Twitter the scope of this activity varied greatly.

Charting the flightKeen to follow the way the online conversation changes according to the different stages of the flying journey we further split our data into three main areas: before take-off, during the flight and after landing. The aim of this activity was to try and gauge which areas matter most to customers and how this varies according to airline type.

Before take-offLooking exclusively at mentions of customers’ experiences before boarding, our data clearly showed that experiences of booking tickets are the biggest pre-boarding area of interaction with airlines. After this, boarding and check-in are also significant pre-flight topics, as are delays and baggage issues.

During the flightSafely boarded onto the plane, seating becomes the focus for most passengers, accounting for more than one-third of mentions, whether about the lack of legroom and hard seats (AirTran) or the chair massage features (Delta). Following this, comments on the quality of staff service make up almost one-fifth of the remainder of the conversation.

After landingSafely disembarked, comments turns to expressions of airline loyalty or indeed disloyalty as everyone takes stock of their experience. Also high up on the agenda is the punctuality of the plane and whether the luggage arrives in one piece!

ConclusionWhilst some of the above data points might not seem immediately relevant or actionable for airlines, there will be information contained within a charting exercise like this that is hugely valuable to an airline. If airlines can identify what matters to passengers at each stage of their journey, and where they are going to try to connect with airlines, they can make sure to allocate the correct level of resources to the relevant areas and can ensure that they are discovering where and if they can address customers’ needs in real-time. Journey aside, by looking online at candid conversation and tracking genuine, publicly-visible complaints airlines can offer themselves a great way to assess the quality of their customer service. What is more, in such a competitive industry, putting in practices to optimise their engagement on social media sites could prove to be the difference for indecisive passengers flying on competitive routes.